The Secret Credit Loophole the Banks Don't Want You Finding Out About

Erase The Bad Things On Your Credit While Boosting Your Score...

Make Sure Your Sound Is On!

What Do We Fix..?

Using Our Backdoor Credit Reset™ Program, We've Been Able to Help Hundreds of People In Just About

Any Situation, Fix Their Credit to Finance Homes, Cars, Businesses, and Get The best Credit Cards....

Collections...

Late Payments...

Defaulted Credit Cards...

Bankruptcies...

Repos...

Medical Debt...

Student Loans...

Child Support...

Tax Liens...

Foreclosures...

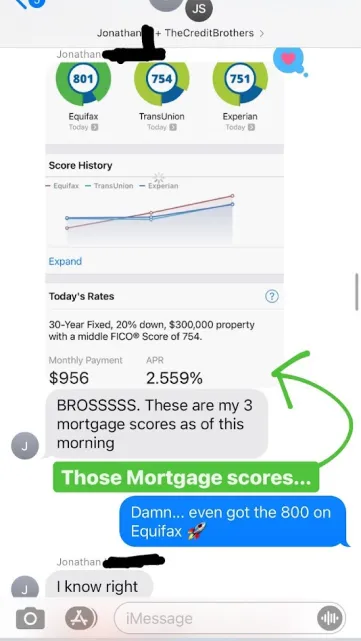

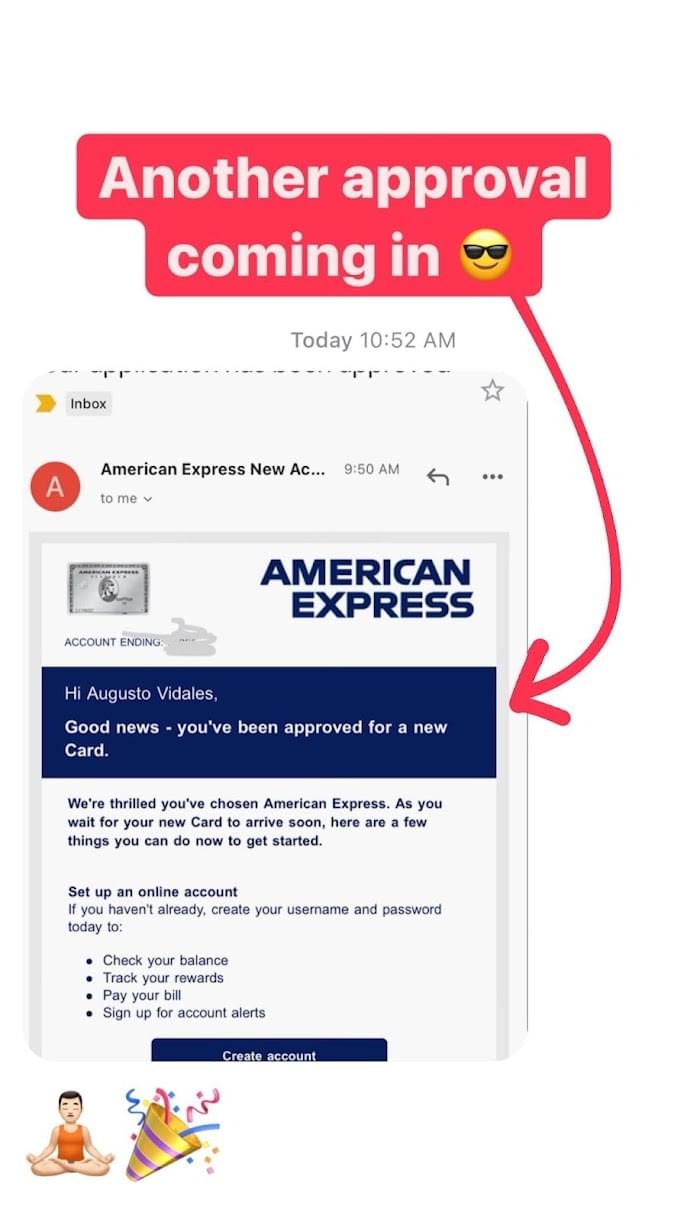

The Backdoor Credit Reset Has Worked For Hundreds of Other People...

If You Want to Find Out If It Will Work For You, Book A Call Using The Button Below:

How Two Brothers Have Helped MILLIONS of People Finance Homes, Cars, and Get the Best Credit Opportunities...

The Credit Brothers are the most trusted source of credit information on social media.

They design their content specifically to help the every day person take advantage of the credit system, instead of letting the credit system take advantage of them.

Their knowledge has impacted millions of lives, earning them over 400,000 loyal followers and over 50 million views in just under 2 years.

The Secret Credit Loophole The Banks Don't Want You Finding Out About...

Erase The Bad Things On Your Credit Report While Boosting Your Score

make sure your sound is on!

What Do We Fix..?

Using Our Backdoor Credit Reset™ Program, We've Been Able to Help Hundreds of People Remove Bad Things And Fix Their Credit to Finance Homes, Cars, Businesses, and Get The best Credit Cards....

Collections...

Late Payments...

Defaulted Credit Cards...

Bankruptcies...

Repos...

Medical Debt...

Student Loans...

Child Support...

Tax Liens...

Foreclosures...

The Backdoor Credit Reset Has Worked For Hundreds of Other People...

If You Want to Find Out If It Will Work For You, Book A Call Using The Button Below

How Two Brothers Have Helped MILLIONS of People Finance Homes, Cars, and Get the Best Credit Opportunities...

The Credit Brothers are the most trusted source of credit information on social media.

They design their content specifically to help the every day person take advantage of the credit system, instead of letting the credit system take advantage of them.

Their knowledge has impacted millions of lives, earning them over 1,000,000 Million loyal followers and over 100 million views in just under 3 years.

Simona's Dream Was to Be a Home Owner...

But the banks told her no because her credit score was too low...

Using a secret loophole that my brother and I found called the Backdoor Credit Reset™, we were able to take her credit score from a 521 to a 718.

Now The Banks Said YES!

Watch Simona's Video Testimonial!

1

2

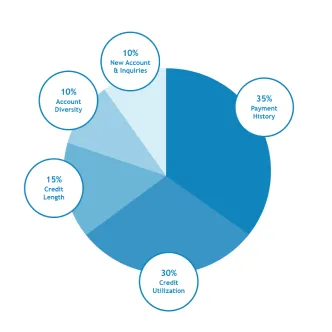

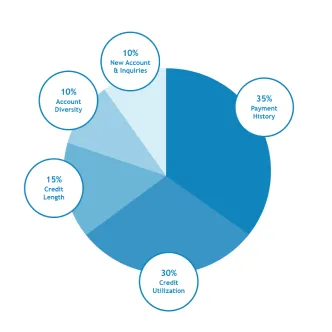

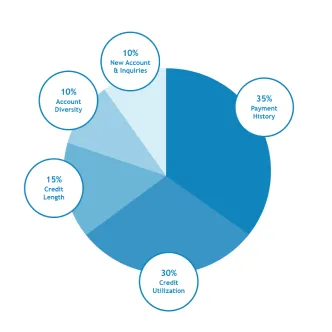

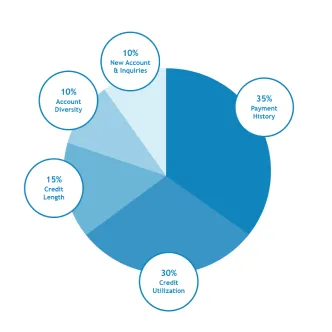

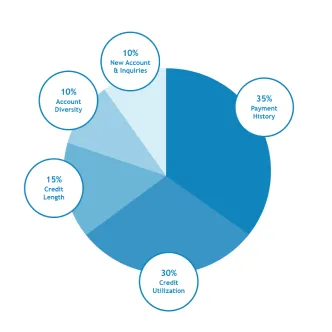

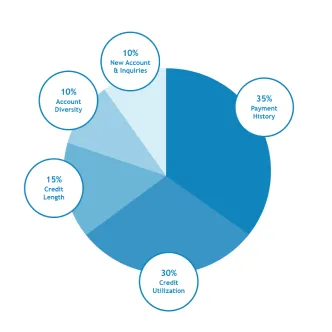

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

Les's Dream Was To Make Passive Income...

But Banks Wouldn't Finance His Business Because Of His Credit...

Using the Backdoor Credit Reset™, we were able to take his credit score from a 540 to a 705.

Because of the Credit Reset, Les Was Able To Finance Over $100,000 in Cars and Start His Passive Income Rental Car Business...

Watch Les's Video Testimonial!

1

2

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

Carey Needed A New Car For Work...

But the banks would only finance it at an absurd 13% interest rate because of her credit score...

Using the Backdoor Credit Reset™, we were able to take her credit score from a 595 to a 711.

Now, she was able to finance her new car at a 1.9% interest rate and saving over $5,000...

Watch Carey's Video Testimonial!

1

2

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

What Makes The Backdoor Credit Reset Different From Companies..?

Still Don't Understand? Let Us Explain...

Did you know that most credit repair companies charge on a monthly basis? Because of this, it's in their best interest to take as long as possible with your credit repair. Most customers will pay but never see results.

We do things differently. For a one-time investment, we will remove as many bad things from your credit while also guiding you on how to add good things to boost your score.

Did you know that most credit repair companies charge on a monthly basis? Because of this, it's in their best interest to take as long as possible with your credit repair. Most customers will pay but never see results.

We do things differently. For a one-time investment, we will remove as many inquiries from your credit while also guiding you on how to add good things to boost your score.

1

2

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

"Why Are You Doing This?"

3 years ago, my brother and I noticed that the banks were the gatekeepers to some of life's most important milestones...

Buying a house, getting a car, owning a business, and getting access to financial opportunity...

But the banks created two classes of citizens:

Those they help, and those they milk for profit...

And how the banks decide whether they're going to help you achieve your goals, or milk you for money is based on your credit score...

People with a good credit score get access to the best credit cards, the best loans, the best deals, and more financial opportunity...

People with bad credit are charged higher interest rates, are milked for money, and are denied access to financial opportunity...

"Why Are You Doing This?"

3 years ago, my brother and I noticed that the banks were the gatekeepers to some of life's most important milestones...

Buying a house, getting a car, owning a business, and getting access to financial opportunity...

But the banks created two classes of citizens:

Those they help, and those they milk for profit...

And how the banks decide whether they're going to help you achieve your goals, or milk you for money is based on your credit score...

People with a good credit score get access to the best credit cards, the best loans, the best deals, and more financial opportunity...

People with bad credit are charged higher interest rates, are milked for money, and are denied access to financial opportunity...

The Uncomfortable Truth About Bad Credit...

Bankers Use Bad Credit to Milk Hardworking Americans...

They Want You To...

- Pay $18,432 MORE on Auto Loans...

- Pay $25,455 MORE on Credit Cards...

- Pay $42,630 MORE on Auto Insurance...

- Pay $227,880 MORE on a Mortgage...

- Pay 2X Security Deposits on Renting a Home...

- Get Denied for High Paying Jobs...

- Pay $18,432 MORE on Auto Loans...

- Pay $25,455 MORE on Credit Cards...

- Pay $42,630 MORE on Auto Insurance...

- Pay $135,455 MORE on a Mortgage...

- Pay 2X Security Deposits on Renting a Home...

- Get Denied for High Paying Jobs...

Assumptions: $250,000 mortgage at a 6% rate vs a 3.5% rate over 30 years; Four 48 month auto loans at a 15.11% vs a 7.17% rate; auto insurance every day for 30 years; A $6,000 balance on a credit card over 30 years with a 24% vs 12% interest rate.

The worst is that the banks make it

as hard for you to have good credit...

You're never taught anything about credit in school, college, or at work...

And the banks built a backwards system where being responsible can actually hurt you...

Pay off your collections? That can lower your score...

Close down credit cards? Your score IS going to drop...

Make one little mistake? Get punished for 7 years...

The Harsh Reality Is That The Credit System is Unfair and Designed for Failure...

But with the right help, my brother and I believe that ANYONE can have this system working in their favor, instead of against them...

1

2

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

Let Us Fix Your Credit For You

And Never Let a Bank Tell You No Again...

Every month my brother and I offer 30 people a chance to join our Backdoor Credit Reset Program, where they get to wake up 6 months later with their new and improved credit score.

This is a completely done-for-you service where we use the Backdoor Credit Reset Program to wipe away as many negative items for your credit as possible.

Meanwhile, we will help you add as many good things to your credit report as possible so that you can achieve your desired goal.

Every month my brother and I offer 30 people a chance to join our Backdoor Credit Reset Program, where they get to wake up 6 months later with their new and improved credit score.

This is a completely done-for-you service where we use the Backdoor Credit Reset Program to wipe away as many negative items for your credit as possible.

Meanwhile, we will help you add as many good things to your credit report as possible so that you can achieve your desired goal.

1

2

Creditors like banks, credit card companies, cell phone providers and even hospitals, report your payments to the credit bureaus. These bureaus (Experian, Equifax and TransUnion) keep a record of everything reported to them both positive and negative.

We’ve helped hundreds of clients achieve things they never thought possible...

It’s time to stop being held back from living a life you deserve.

Countless Transformations & Many More To Come...

Have Questions? Check Out Our FAQ

What is credit repair?

Credit repair is the process of addressing any questionable negative items that could be hurting your credit profile. If the bureaus and the creditors can’t prove these items are fair, accurate, and substantiated, they are required by law to remove them. It's building your credit report in a way that makes it easier to remove these items. We handle that in our repair process for you.

What Guarantee Do We Offer?

While we can't guarantee a 100% removal of all negative items, we guarantee that we won't accept your money if we don't think that we can get you results

Can my credit be repaired?

Everyone has the opportunity for their credit to be repaired. We are keeping up to date with the latest dispute methods and utilizing the law to the fullest extent we can. Even if you've tried in the past and didn't see results, there is still an opportunity for your credit to be fixed.

How long does credit repair take?

On average we work with our clients for 6 months. If you have items like bankruptcies expect a longer time and if you have only 1 or 2 items then it can be less than 6 months. On our call together our team can provide you with an individualized estimate for your situation.

How Much Does Credit Repair Cost?

The cost of the repair is based on the scope of work defined when we audit your credit report. Because everyone's situation is different the cost of the service will be dependent on what we will be working on. For an estimate, schedule a call with our team using the link below.

Ready To Transform Your Credit?

Book your backdoor credit reset call to see how we can help you achieve your goals!

Ready To Transform Your Credit?

Book your credit comeback call to see how we can help you achieve your goals!

This product is brought to you and copyrighted by the The Credit Brothers©

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.